All about Rating On Appliances

The Single Strategy To Use For Rating On Appliances

Table of ContentsThe Greatest Guide To Rating On AppliancesAbout Rating On AppliancesAn Unbiased View of Rating On AppliancesGetting My Rating On Appliances To Work

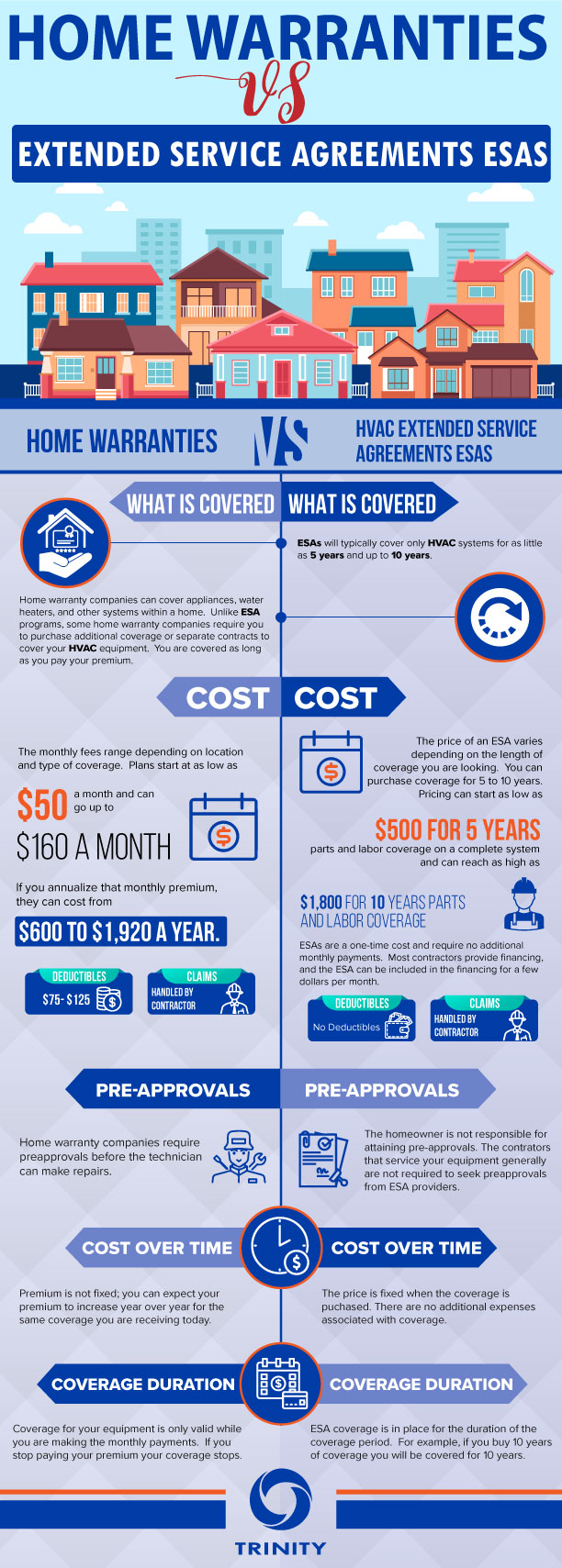

Residence insurance coverage might likewise cover clinical expenses for injuries that people received by being on your property. A property owner pays an annual costs to their homeowner's insurance policy firm. On average, this is somewhere in between $300-$1,000 a year, depending upon the plan. When something is harmed by a disaster that is covered under the house insurance coverage, a homeowner will call their residence insurer to submit a case.House owners will typically need to pay an insurance deductible, a fixed amount of money that appears of the house owner's budget prior to the home insurer pays any type of money towards the insurance claim. A residence insurance policy deductible can be anywhere in between $100 to $2,000. Generally, the greater the deductible, the reduced the annual costs price.

What is the Distinction In Between House Warranty and also House Insurance A residence guarantee agreement and also a home insurance plan operate in comparable methods. Both have a yearly premium and an insurance deductible, although a home insurance policy costs as well as deductible is usually a lot more than a house guarantee's. The main differences between residence warranties as well as house insurance policy are what they cover.

An additional difference in between a residence warranty as well as home insurance is that home insurance policy is generally needed for property owners (if they have a home loan on their house) while a house service warranty plan is not required. A house guarantee and also house insurance offer security on different parts of a residence, as well as together they can secure a homeowner's spending plan from pricey fixings when they inevitably emerge.

Rating On Appliances Fundamentals Explained

If there is damage done to the framework of your house, the owner will not need to pay the high expenses to repair it if they have house insurance policy. If the damage to the residence's framework or property owner's personal belongings was produced by a malfunctioning devices or systems, a home warranty can assist to cover the costly repairs or substitute if the system or home appliance has fallen short from normal deterioration - rating on appliances.

They will certainly collaborate to provide protection on every component of your residence. If you have an interest in buying a house guarantee for your house, have a look at Landmark's home service warranty strategies and also pricing right here, or demand a quote for your home below.

The distinction is that a house guarantee covers a variety of things rather than just one. There are 3 standard types of home service warranty plans. System prepares cover your house's mechanical systems, including heating as well as air conditioning, electric and plumbing. Appliance strategies cover significant home appliances, like the dishwashing machine, stove and also washing maker.

Rating On Appliances Things To Know Before You Buy

Some things, like in-ground sprinklers, swimming pools as well as septic tanks, may require an extra service warranty or may not be covered by all home warranty business. look what i found When contrasting house warranty companies, make certain the strategy choices encompass everything you would certainly desire covered. rating on appliances.New building and construction residences frequently included a warranty from the contractor.

Building contractor service warranties normally do not cover appliances, though in an all new house with brand-new appliances, producers' service warranties are likely still in play. If you're getting a home warranty for a brand-new house either new building and construction or a home that's new to you insurance coverage normally begins when you close.

In other words, if you're buying a home and a problem turns up throughout the home evaluation or is kept in mind in the seller's disclosures, your residence guarantee company may not cover it. As opposed to counting solely on a guarantee, try to negotiate with the seller to either fix the issue or offer you a credit rating to assist cover the expense of having it taken care of.

Some Ideas on Rating On Appliances You Need To Know

home insurance policy, A home warranty is not the like home owners insurance policy. For one, house owners insurance policy is needed by lenders in order to obtain a mortgage, while a residence warranty is totally optional. However the larger distinctions are in what they cover and also exactly how they work. As mentioned over, a home guarantee covers Get More Info the repair work as well as substitute of products as well as systems in your residence.

Your house owners insurance, on the other hand, covers the unforeseen. It won't help you replace your home appliances because they obtained old, yet homeowners insurance might aid you obtain brand-new devices if your existing ones are harmed in a fire or flooding. With property owners insurance, you'll need to satisfy a insurance deductible prior to the insurance company begins paying for the expense of your case.

Just how much does a residence warranty cost? Residence service warranties normally set you back in between $300 and $600 each year; the expense will certainly differ relying on the kind of strategy you have. The extra that's covered, the pricier the plan those attachments can include up. Where you live can also affect the cost.

Though you won't pay for the real repair services, you will certainly pay a service fee whenever a tradesperson involves your residence to examine a problem. If greater than one pro is called for, you could wind up paying a service charge greater than when for the exact same work. This fee can range from regarding $60 to $125 for every service circumstances, making the service charge an additional indicate think about if you're purchasing a residence warranty strategy.